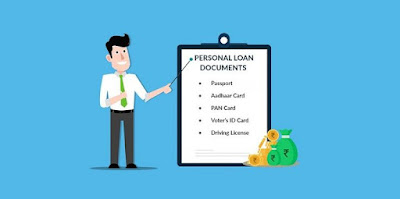

What Are the Documents Required for a Personal Loan?

Applicants must provide certain Personal Loan documents to the loan providers to qualify for a loan. Financial institutions request these documents to verify the financial and personal information you have provided while applying for a personal loan. They review them before taking a final decision.

While each lending institution has its unique documentation requirements, standard documents required for Personal Loans are as follows:

Duly Filled Application Form: Lending institutions have online applications to let people apply. It often requires the applicant to mention personal details like their name, contact details, address, date of birth, etc. Some application forms also require financial and other information, which the applicant must enter accurately.

Identity Proof: For obvious reasons, lending institutions want to confirm an applicant's age and citizenship with identity proof like an Aadhaar card and PAN card.

Address Proof: Applicants can easily verify their residential address with an Aadhaar card, passport, driving license, voter ID, etc.

Income Proof: Income proof shows financial stability. Prove it with the last three month's salary slip or Form 16.

Online lending institutions do not require applicants to submit hard copies of their personal loan documents. Provide KYC details online and get them verified within seconds.